bitcoinrevival.site

Recently Added

What Are The Tax Brackets For Filing Jointly

Maryland Income Tax Rates. Taxpayers Filing as Single, Married Filing Separately, Dependent Taxpayers or Fiduciaries, Taxpayers Filing Joint Returns, Head. California tax brackets for Married/Registered Domestic Partner Filing Jointly taxpayers and Qualifying Surviving Spouse/RDP ; $, – $, %. For married couples filing jointly, the range is $89, to $, Incomes within this bracket are taxed at a 22% rate. filing jointly, married filing separate, and head of household). In recent years, taxable income brackets have been increased each year, while the tax rates. Tax Brackets ; 10%, $0 – $11,, $0 – $22, ; 12%, $11, – $44,, $22, – $89, ; 22%, $44, – $95,, $89, – $ ; 24%, $95, –. filing your Individual Income Tax return, the SCDOR recommends Claim the two wage earner credit unless the filing status is married filing jointly. Tax brackets ; 10%, Not over $11,, Not over $23, ; 12%, Over $11, but not over $47,, Over $23, but not over $94, ; 22%, Over $47, but not. For Tax Year , the North Carolina individual income tax rate is % (). Tax rates for previous years are as follows: For Tax Years , , and. Federal Income Tax Brackets and Rates for Single Filers, Married Couples Filing Jointly, and Heads of Households ; 12%, $11, to $44,, $22, to. Maryland Income Tax Rates. Taxpayers Filing as Single, Married Filing Separately, Dependent Taxpayers or Fiduciaries, Taxpayers Filing Joint Returns, Head. California tax brackets for Married/Registered Domestic Partner Filing Jointly taxpayers and Qualifying Surviving Spouse/RDP ; $, – $, %. For married couples filing jointly, the range is $89, to $, Incomes within this bracket are taxed at a 22% rate. filing jointly, married filing separate, and head of household). In recent years, taxable income brackets have been increased each year, while the tax rates. Tax Brackets ; 10%, $0 – $11,, $0 – $22, ; 12%, $11, – $44,, $22, – $89, ; 22%, $44, – $95,, $89, – $ ; 24%, $95, –. filing your Individual Income Tax return, the SCDOR recommends Claim the two wage earner credit unless the filing status is married filing jointly. Tax brackets ; 10%, Not over $11,, Not over $23, ; 12%, Over $11, but not over $47,, Over $23, but not over $94, ; 22%, Over $47, but not. For Tax Year , the North Carolina individual income tax rate is % (). Tax rates for previous years are as follows: For Tax Years , , and. Federal Income Tax Brackets and Rates for Single Filers, Married Couples Filing Jointly, and Heads of Households ; 12%, $11, to $44,, $22, to.

Use the table below to assist you in estimating your federal tax rate. TAX RATE, SINGLE, HEAD OF HOUSEHOLD, MARRIED FILING JOINTLY OR QUALIFYING WIDOW, MARRIED. Below is listed a chart of all the exemptions allowed for Mississippi Income tax. Married Filing Joint or Combined*, $12, Married Spouse Deceased, $12, The personal income tax rates vary depending upon your filing status, income, and taxable year. If I filed “married filing jointly” on my federal tax. Current Tax Rates ; Gross Premiums Tax, 2 percent plus any retaliatory tax 3 percent surplus lines tax rate is imposed on policies written with unlicensed non-. For married couples filing jointly, the range is $22, to $89, Income falling within this bracket is taxed at a 12% rate. 22% Bracket: The 22% bracket. Historical Tax Tables may be found within the Individual Income Tax Booklets. Note: The tax table is not exact and may cause the amounts on the return to be. Current Income Tax Rates · 10% tax rate for income between $0 and $20, · 12% tax rate for income between $20, and $83, · 22% tax rate for income between. Tax Rate, For Single Filers, For Married Couples Filing Jointly ; 10%, $11, or less, $23, or less ; 12%. Thanks for visiting the tax center. Below you will find the tax rates and income brackets. ; Married/Filing jointly and qualifying widow(er)s, $0, $20, Filing Status: Single, Married filing jointly, Married filing separately, Head of household. If your taxable income is between your tax bracket is: and, %. Your federal tax rates are based on your income level and filing status. The percentages and income brackets can change annually. Schedule Y-1—Use if your filing status is Married filing jointly or Qualifying surviving spouse. If your taxable income is: Over--, But not over--, The tax is. Tax Rates. Filing & Paying Your Taxes · Payment Options · Penalties and Interest · Extensions and Prepayment · Income Tax Estimator · Tax Rates · Payment. In , there are seven federal tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. The bracket depends on taxable income and filing status. The Optional Tax Table and the X and Y Tax Table are now obsolete. $1, for married taxpayers filing a joint return. Credit for Contributions. Marginal tax rate: Your tax bracket explained ; Married Filing Jointly ; Income, Tax Bracket ; $22,, 10% ; $89,, 12% ; $,, 22%. Individual income tax brackets and rates; Tax Commissioner; duties; tax tables; other taxes; tax rate ; Number, Individuals, Filing ; Jointly ; 1, $ Filing jointly is usually better when the income disparity between spouses is high because this usually results in being placed into a lower tax bracket. Filing Season Updates · Free File Offers · Free Tax Preparation Assistance · File Vermont Rate Schedules and Tax Tables. Tax Year Vermont Rate. Virginia's income tax is imposed at graduated rates, starting at 2% and capping at %. The highest rate applies to income over $17, When a married couple.

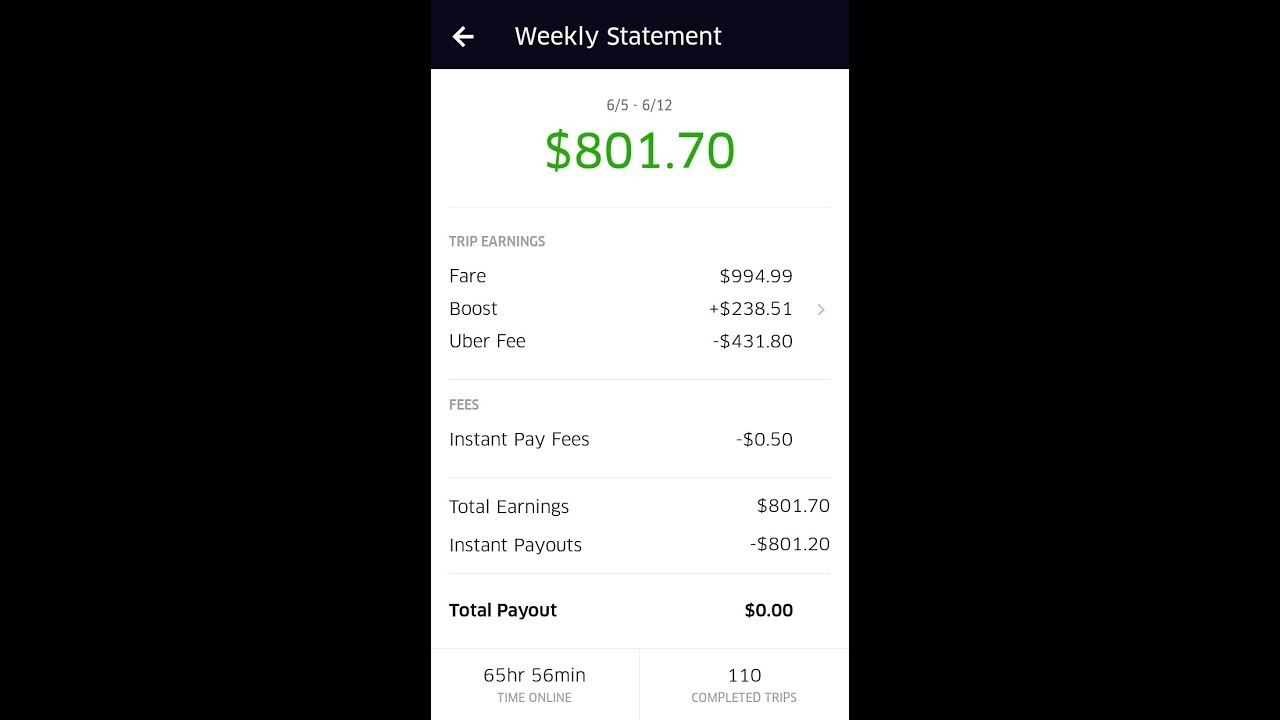

How Much Do You Earn On Uber Eats

The minimum amount you can cash out is $; Next-day - you are able to cash out twice per day and up to a total of $ per week (resets every Monday). The. Sign up for Uber Eats and earn 1, Aeroplan points when you place your first food, retail, or grocery delivery order8. Earn 1. You will make approximately $$25 per hour. This estimate can change depending on market demand and which hours you work. You can expect to. Doing Uber Eats can be a great way to earn extra money in your spare time. With Uber Eats, you get to set your own schedule and be your own boss. On an average day we do over $1k of sales on Uber Eats. At 30% we are paying them $ And with Uber Eats, we often have 5 or more deliveries. Getting Paid · Next-day cash out. Get your earnings within one business day* when you cash out in the Uber Driver app before pm local time, Mon-Fri at no. On average, UberEats drivers usually make about $18 per hour before expenses, making this a potentially decent income. Uber Eats, as with many food delivery apps, pays its drivers on a piece rate. That is to say, you get paid per delivery you make, rather than per hour. Monthly earnings average around $ per month. Gross earnings per trip are between $ and $ Tips make up about 50% of most Uber Eats drivers'. The minimum amount you can cash out is $; Next-day - you are able to cash out twice per day and up to a total of $ per week (resets every Monday). The. Sign up for Uber Eats and earn 1, Aeroplan points when you place your first food, retail, or grocery delivery order8. Earn 1. You will make approximately $$25 per hour. This estimate can change depending on market demand and which hours you work. You can expect to. Doing Uber Eats can be a great way to earn extra money in your spare time. With Uber Eats, you get to set your own schedule and be your own boss. On an average day we do over $1k of sales on Uber Eats. At 30% we are paying them $ And with Uber Eats, we often have 5 or more deliveries. Getting Paid · Next-day cash out. Get your earnings within one business day* when you cash out in the Uber Driver app before pm local time, Mon-Fri at no. On average, UberEats drivers usually make about $18 per hour before expenses, making this a potentially decent income. Uber Eats, as with many food delivery apps, pays its drivers on a piece rate. That is to say, you get paid per delivery you make, rather than per hour. Monthly earnings average around $ per month. Gross earnings per trip are between $ and $ Tips make up about 50% of most Uber Eats drivers'.

Any remaining earnings, including anything you earn from referral rewards and promotions, will be transferred to your bank account by the end of the week. Why. Key takeaways · Uber Eats delivery drivers in the US earn a national average hourly rate of $19 · The base fares Uber Eats pay range from $2 to $4 · Uber Eats. Based on our data, earnings in Uber Eats in Poland in are on average 20,85 PLN gross per hour and 11,89 PLN gross for a single order. You can earn more points every day when you link your accounts. Earn on qualifying food and grocery orders for delivery with Uber Eats and rides with Uber. The average UberEATS salary ranges from approximately $31, per year for Driver to $62, per year for Account Representative. Salary information comes from. You can see a quick earnings overview at the top of the app. You can tap your earning cards and swipe right and left to see your daily and weekly earnings at a. Uber Eats drivers earn between $ and $ per hour, with annual incomes ranging from about $26, to $41, for full-time work. · Earnings depend on. ³You'll be charged fees on orders. If at the end of each month you've received fewer than 20 orders, we'll refund the fees you've paid. To be eligible. Where can I see my earnings? How do I make an adjustment? If you have an issue with a fare, you. According to Indeed, Uber Eats drivers can expect to make $ an hour, on average. If you work 20 hours per week, that's around $ per week. If you work The average pay range for an Uber Eats Delivery Driver varies greatly (as much as $), which suggests there may be many opportunities for advancement and. Key takeaways · Uber Eats delivery drivers in the US earn a national average hourly rate of $19 · The base fares Uber Eats pay range from $2 to $4 · Uber Eats. For $ per month, Uber One subscribers enjoy $0 Delivery Fee and up to 10% off orders over $15 at participating non-grocery stores (and 5% off orders over. How much does a Delivery Driver make at UberEATS in the United States? Average UberEATS Delivery Driver hourly pay in the United States is approximately. You'll get paid for every pickup and dropoff you complete, plus a per-mile rate. In some cities, you'll also receive a per-minute rate. In addition, Uber Eats. ³You'll be charged fees on orders. If at the end of each month you've received fewer than 20 orders, we'll refund the fees you've paid. To be eligible. Uber One members in the United States earn 6% Uber Cash on eligible rides taken. Uber Cash can be used on both Uber and Uber Eats, so you can use it on trips. On average, Uber Eats drivers earn around $8 to $12 per hour after expenses. But if you're willing to ride the high tides of lunch and dinner times, you could. Get food delivery to your doorstep from thousands of amazing local and national restaurants. Find the meal you crave and order food from restaurants easily.

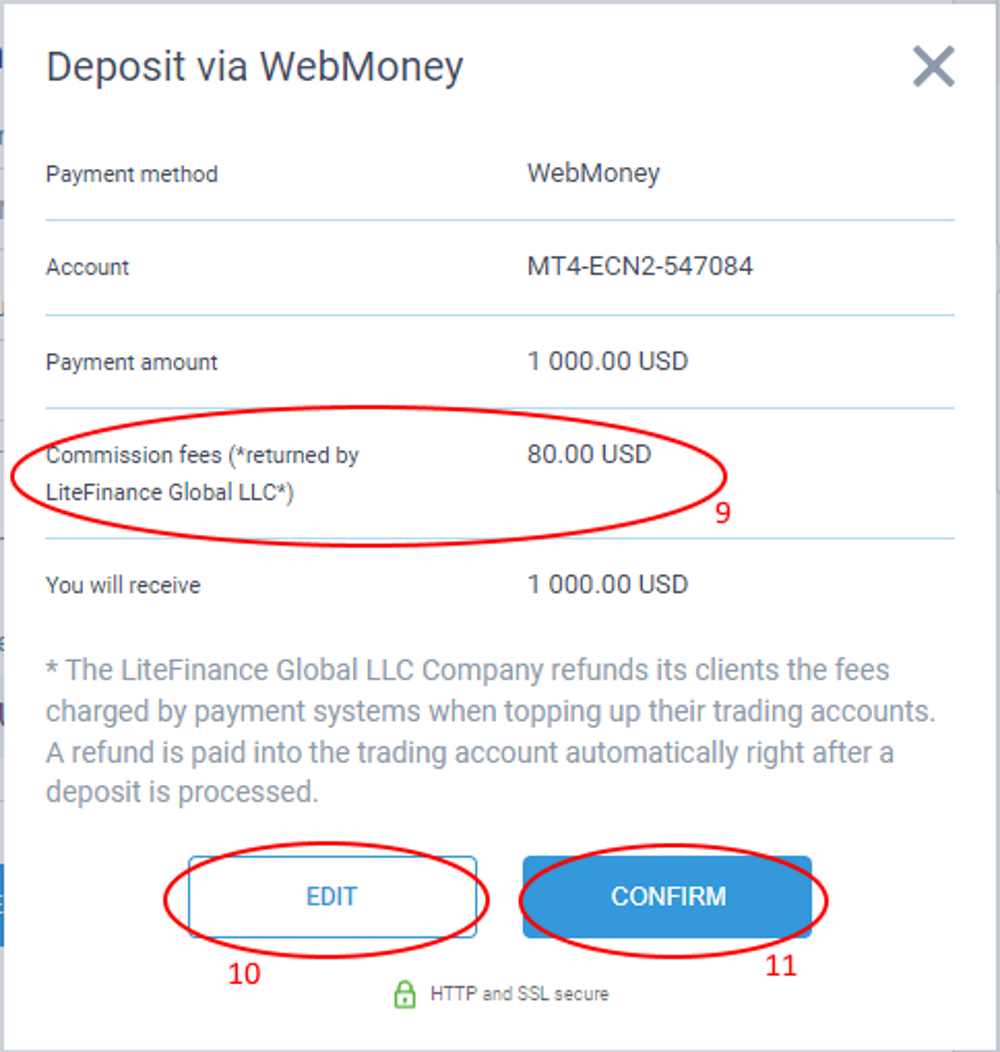

Demo Forex Accounts

With the Octa demo account, you get a full trading experience while using only virtual funds without risking any real money. Open a free demo trading account for online trading with simulated funds to test the platform and your trading strategies risk-free on live markets. Our free demo forex accounts will allow you to practise and hone in your trading skills risk-free until you feel confident enough to trade live. A Demo account simulates trading in the live markets, using real market data, but with virtual funds instead of real money. account_circle_outline_24px. Experience risk-free currency trading with our ADSS demo account. Gain hands-on experience in trading global currencies and perfect your trading skills with. A demo account provides you with the opportunity to try our web trading platforms in an environment with reduced risk. Register for a free Forex demo account with FXTM. For beginners, our demo accounts let you practice trading in real market conditions with virtual currency. Traders can test out each platform using a demo account, which means no real money is at risk. Here, we'll discuss the importance of demo trading. Open an FXCM forex and CFD demo account and practice forex trading risk free. Get live buy and sell prices, £50K of virtual money and access to trading. With the Octa demo account, you get a full trading experience while using only virtual funds without risking any real money. Open a free demo trading account for online trading with simulated funds to test the platform and your trading strategies risk-free on live markets. Our free demo forex accounts will allow you to practise and hone in your trading skills risk-free until you feel confident enough to trade live. A Demo account simulates trading in the live markets, using real market data, but with virtual funds instead of real money. account_circle_outline_24px. Experience risk-free currency trading with our ADSS demo account. Gain hands-on experience in trading global currencies and perfect your trading skills with. A demo account provides you with the opportunity to try our web trading platforms in an environment with reduced risk. Register for a free Forex demo account with FXTM. For beginners, our demo accounts let you practice trading in real market conditions with virtual currency. Traders can test out each platform using a demo account, which means no real money is at risk. Here, we'll discuss the importance of demo trading. Open an FXCM forex and CFD demo account and practice forex trading risk free. Get live buy and sell prices, £50K of virtual money and access to trading.

A Forex demo account is a practice trading account which allows traders to learn how to trade the Forex market without risking their own money. It provides a. Open a Demo account with IC Markets Global. Trade with MetaTrader 4, cTrader and MetaTrader 5. Start trading now! Start practising forex trading immediately with our demo forex account in just a few minutes. Improve your trading ability with our demo account. Beginners Ease into Trading. If you are new to trading, you can use your demo account to practice trading and improve your skills with virtual funds and zero. Create your demo trading account in minutes. Where do you live? Select your country/region. Confirm and continue. A demo account is the best way for novice traders to explore MetaTrader 4 and receive their first trading experience in the currency markets. Forex Demo Account. If you are a novice trader, the FXOpen free demo account can help you practice Forex trading without putting real money at risk. A Forex. Open a free Demo account with Fusion Markets. Explore the benefits of our trading platform and receive your first trading experience in the Forex market. RoboForex demo accounts are different from real ones in that you don't need to deposit any real money for trading on them. This is why using a demo account is. Open a. Demo Trading Account Now · 1. Register. Quick and easy account opening process. · 2. Fund. Fund your trading account with an extensive choice of deposit. Open an online demo trading account to build trading skills. Explore our award-winning trading platform with $ virtual funds. Start a forex demo. Open DEMO account (Forex / CFD) Try trading on a day demo account. Personal Data Account Settings First name Last name E-mail Phone. How do I open a live account? Apply for an account by submitting your contact details, your trading experience and valid proof of your identity and address. Gain confidence and experience with a risk-free Demo Account before entering the market, with real trading conditions and $ of funds to practice with. With JustMarkets demo accounts, you can trade over instruments, including currency pairs, stocks, indices, metals, and energy commodities. The demo account allows you to learn about the mechanics of forex trading and test your trading skills and processes with ZERO risk. Open a free demo account with Fxview. Trade a wide range of instruments like forex, commodities, cryptos, stocks & indices and get their live prices. ⭐ No-Expiration DEMO Forex Brokers ; Crystal Ball Markets. Unlimited, Mobius Trader 7 ; Daxbase. Unlimited, Web Platform ; Dollars Markets. Unlimited, MT4, MT5. The primary difference between a demo account and a live trading account is that there is no capital at risk when trading in a bitcoinrevival.site demo account. A demo account is a type of account offered by brokers to simulate the real market environment on their trading platform. The biggest difference is that instead.

Private Bankers

Bank of America Private Bank provides comprehensive wealth management services and customized financing solutions to meet your private banking needs. Asian Private Banker delivers independent, authoritative and indispensable intelligence, data and connections on Asia's burgeoning private wealth management. Private banking consists of personalized financial services and products offered to the high-net-worth individual (HNWI) clients of a retail bank or other. John Lee, Manager, STAR Private Banking, 46 Monument Circle Indianapolis, IN , , Email John (Opens in a new Window). A private banker provides in-depth analysis on an individual or company's financial circumstances and makes recommendations based on specific investment. Designed to strengthen your prospects. Your Private Banker serves you with premier deposit or lending 1 solutions and introduces you to a team of trusted. With BOK Financial private banking services you'll get tailored banking, investments, and expert advice for all your financial planning and goals. As our Private Client, you can expect a personalized banking relationship with a Private Banker dedicated to providing you proactive concierge-level service. Broadway Bank's Private Banking team provides concierge financial services curated specifically for your business and personal needs. Bank of America Private Bank provides comprehensive wealth management services and customized financing solutions to meet your private banking needs. Asian Private Banker delivers independent, authoritative and indispensable intelligence, data and connections on Asia's burgeoning private wealth management. Private banking consists of personalized financial services and products offered to the high-net-worth individual (HNWI) clients of a retail bank or other. John Lee, Manager, STAR Private Banking, 46 Monument Circle Indianapolis, IN , , Email John (Opens in a new Window). A private banker provides in-depth analysis on an individual or company's financial circumstances and makes recommendations based on specific investment. Designed to strengthen your prospects. Your Private Banker serves you with premier deposit or lending 1 solutions and introduces you to a team of trusted. With BOK Financial private banking services you'll get tailored banking, investments, and expert advice for all your financial planning and goals. As our Private Client, you can expect a personalized banking relationship with a Private Banker dedicated to providing you proactive concierge-level service. Broadway Bank's Private Banking team provides concierge financial services curated specifically for your business and personal needs.

This is a guide on Private Banking by M&I. Recommend it highly to anyone looking into the industry. Private Banking · Checking & Private Money Market. Tailor-made to suit your needs, our Private accounts offer competitive interest and customizable limits. Private Banking We offer personalized services and advice for all your wealth management needs. Discover Private Banking See all our solutions. Your former HSBC Bank Canada Private Client Services products and services have started migrating to RBC Private Banking. Bankers Trust offers private banking to help customers grow, manage and protect their wealth with an elite level of service. A uniquely elevated private banking experience shaped around you. · Wealth Planning & Advice · Investing · Lending · Banking. We have extensive personal and. CIBC US Locations Consumer and commercial banking products and services are offered through CIBC Bank USA. Member FDIC and Equal Housing Lender. All loans are. FNB provides private banking and investment services to help reach your financial goals. Manage your wealth with our personal bankers and choose FNB. Northwest Bank provides a personal concierge service to make your banking experience easy. You will work with an assigned Private Banker who will care for your. Private banking is centered around you—it offers a personalized experience in which your wealth needs and goals are at the forefront of every action. As our Private Client, you can expect a personalized banking relationship with a Private Banker dedicated to providing you proactive concierge-level service. Citi Private Bank is dedicated to serving wealthy individuals and families through outstanding private banking services, helping clients preserve & grow. This certificate program prepares private bankers with knowledge about integrated wealth planning and advice, investment and asset management strategies, legal. Our exclusive Private Banking program provides you with a team of experienced and trained professionals to take care of all of your financial needs in one. Private banking is an entrepreneurial field where you build a client list, advance based on your own merits, and enjoy high compensation and a great lifestyle. Private banking at TowneBank provides a personalized approach for both you and your business. Private bank accounts can feature higher interest rates on your deposits. For example, Bank of America offers a 20% interest rate upgrade on its savings. Employment and Salary Expectations for Private Bankers. According to the U.S. Bureau of Labor Statistics (BLS), the median salary for personal financial. Private banking is a general description for banking, investment and other financial services provided by banks and financial institutions primarily serving. Frost Private Banking provides a rare combination of expertise and personal service to help you with the challenges of financial success.

Tax Rate On Stocks

Gains from the sale of collectibles, such as art, antiques, coins, and precious metals, are subject to a higher long-term capital gains tax rate of 28%. Whereas. Depending on your taxable income and tax filing status, you'd be taxed at one of these three rates: 0%, 15%, or 20%. Overall, long-term capital gains tax rates. Depending on your income level, and how long you held the asset, your capital gain on your investment income will be taxed federally between 0% to 37%. The taxable part of a gain from selling Internal Revenue Code Section qualified small business stock is taxed at a maximum 28% rate. Specifically, for. From a tax perspective, sellers may prefer a stock sale because the gain on the sale will likely be taxed as long-term capital gains at a top current federal. Short term gains on stock investments are taxed at your regular tax rate; long term gains are taxed at 15% for most tax brackets, and zero for the lowest two. Gains arising from sale of stock are taxed at a total rate of % (% for national tax purposes and 5% local tax). Gains arising from sale real. For qualified dividends, three tax rates of 0%, 15% or 20% apply based on an investor's taxable income and filing status while nonqualified dividends are taxed. There are only three tax rates for long-term capital gains: 0%, 15% and 20%, and the IRS notes that most taxpayers pay no more than 15%. Gains from the sale of collectibles, such as art, antiques, coins, and precious metals, are subject to a higher long-term capital gains tax rate of 28%. Whereas. Depending on your taxable income and tax filing status, you'd be taxed at one of these three rates: 0%, 15%, or 20%. Overall, long-term capital gains tax rates. Depending on your income level, and how long you held the asset, your capital gain on your investment income will be taxed federally between 0% to 37%. The taxable part of a gain from selling Internal Revenue Code Section qualified small business stock is taxed at a maximum 28% rate. Specifically, for. From a tax perspective, sellers may prefer a stock sale because the gain on the sale will likely be taxed as long-term capital gains at a top current federal. Short term gains on stock investments are taxed at your regular tax rate; long term gains are taxed at 15% for most tax brackets, and zero for the lowest two. Gains arising from sale of stock are taxed at a total rate of % (% for national tax purposes and 5% local tax). Gains arising from sale real. For qualified dividends, three tax rates of 0%, 15% or 20% apply based on an investor's taxable income and filing status while nonqualified dividends are taxed. There are only three tax rates for long-term capital gains: 0%, 15% and 20%, and the IRS notes that most taxpayers pay no more than 15%.

They're usually taxed at lower long-term capital gains tax rates (0%, 15%, or 20%). Capital gains from stock sales are usually shown on the B. They're subject to a 0%, 15%, or 20% tax rate, depending on your level of taxable income. From mutual funds and ETFs to stocks and bonds, find all the. Long-term capital gains from assets held for more than a year benefit from lower tax rates, which can be 0%, 15%, or 20%, depending on income and filing status. Capital Gains Tax Rates for · Taxable portions of the sale of certain small business stocks are taxed at a 28% maximum rate. · Net capital gains from selling. A capital gains tax is a tax imposed on the sale of an asset. The long-term capital gains tax rates for the 20tax years are 0%, 15%, or 20% of the. In most states, LTCGs are subject to state and applicable local income tax at the same rates as apply to ordinary investment income. Certain states exclude a. For example, any gain from the sale of qualified small business stock that isn't excluded is subject to a special capital gains tax rate of 28%. A special 25%. The Washington State Legislature recently passed ESSB (RCW ) which creates a 7% tax on the sale or exchange of long-term capital assets such as. The three levels for long-term capital gains taxes are 0, 15, and 20 percent. Some special tax treatments exist for specific stocks, collections, and real. Updated Capital gains tax by state table for each state in the country and D.C.. Capital gains state tax rates displayed include federal max rate at. The current capital gains tax rates are generally 0%, 15% and 20%, depending on your income. Even a 20% tax “may be a small price to pay for success,” says Joe. Investors pay capital gains taxes on the sale and qualified dividends of stocks, bonds, real estate and collectible assets. And high-income investors don't just. Returns made on a stock you owned for longer than a year are subject to the long-term capital gains tax rate: 0%, 15% or 20%, depending on your ordinary income. The Federal rates are 0%, 15%, or 20%, depending on filing status and taxable income. Each state may also have a capital gains tax, but each treats them. You generally treat this amount as capital gain or loss, but you may also have ordinary income to report. You must account for and report this sale on your tax. Gains on art and collectibles are taxed at ordinary income tax rates up to a maximum rate of 28 percent. Up to $, ($, for married couples) of. Say you held that Acme Co. stock for one year or longer. The proceeds would be taxed at the long-term capital gains rate, which is lower than the tax rate for. The most common capital gains are realized from the sale of stocks, bonds, precious metals, real estate, and property. Not all countries impose a capital gains. In the United States, individuals and corporations pay a tax on the net total of all their capital gains. The tax rate depends on both the investor's tax. Short-term capital gains tax rates on stocks ; 12%, $9,$44,, $22, - $89,, $15,$59, ; 22%, $44,$95,, $89,$$,, $59,$95,

How Much Does A Helicopter Cost To Rent

Flexjet is the only private jet company to also own and operate helicopters, giving a seamless, door-to-door private travel solution to clients across our group. Helicopter rentals will bring the WOW factor into any special event including a birthday party, photo shoot or wedding. Rent a helicopter anywhere in the. Once toy have your rating, the cost to rent an R22 will be somewhere around $/hr and $/hr for an R Renters insurance for an R22 runs. How much does an hour's helicopter flight cost? Smaller helicopters run approximately $/hr to rent. And include lead and post time (so you aren't going to pay a flat $ for a ride. If you would like for your pilot to wait for you after you land, so that you can embark on a return flight, we are happy to do so (wait fee applied to charge). At Paramount Business Jets we can take care of all your helicopter charter and helicopter rental needs. Find out more about helicopter charter costs here. BEH Destinations and Charter Rates for a Twin Engine Turbine Helicopter (AS Twin Star) From Norwood, Massachusetts. $ per flight hour. We're happy to fly. Helicopter charter flights don't need to be expensive. Our prices vary from $ an hour to $ an hour so you can choose what is best fit to your budget. Flexjet is the only private jet company to also own and operate helicopters, giving a seamless, door-to-door private travel solution to clients across our group. Helicopter rentals will bring the WOW factor into any special event including a birthday party, photo shoot or wedding. Rent a helicopter anywhere in the. Once toy have your rating, the cost to rent an R22 will be somewhere around $/hr and $/hr for an R Renters insurance for an R22 runs. How much does an hour's helicopter flight cost? Smaller helicopters run approximately $/hr to rent. And include lead and post time (so you aren't going to pay a flat $ for a ride. If you would like for your pilot to wait for you after you land, so that you can embark on a return flight, we are happy to do so (wait fee applied to charge). At Paramount Business Jets we can take care of all your helicopter charter and helicopter rental needs. Find out more about helicopter charter costs here. BEH Destinations and Charter Rates for a Twin Engine Turbine Helicopter (AS Twin Star) From Norwood, Massachusetts. $ per flight hour. We're happy to fly. Helicopter charter flights don't need to be expensive. Our prices vary from $ an hour to $ an hour so you can choose what is best fit to your budget.

To receive the child discount, two regular price adult tickets are required to be purchased. Only one child is eligible for this discount. You'll see so many instantly-recognizable landmarks, like the Golden Gate As you would expect, your flight can harmonize with BLADE-arranged helicopter. Air Charter Advisors connects you to private helicopters available for rent in your area. Chartering a helicopter is a great way for executives and luxury. Charter rates are $ per flight hour in the Robinson R44 and $ per flight hour in the Robinson R66 Turbine. Aircraft stand-by time is $ per hour. UBER helicopter ride will cost $$ one way per person on average. But the price fluctuates depending on demand. PRIVATELY owned. Firstly, we only charge for flight time. There is no waiting charge. The final cost depends on several factors. The following helipads are available for Las Vegas helicopter charters. Charter rates for private helicopter rentals range between $2, – $7, per hour. Helicopter rental price per hour: a few examples ; Airbus H, 3, km, €2, ; Airbus H Super Puma, 19, km, €3, The average cost of a helicopter rental starts at EUR per hour. For example, the cost of a Robinson 66 helicopter rental is about EUR per hour. Ready to Fly? ; ITEM. RATE ; R22 Rental (per hour). $ Below are the average flight times and starting rates for popular destinations departing from New York City during regular business hours. 20 Destinations - All. cost-effective, and highly convenient travel option via helicopter charter. Price is for the R44 and can include up to 3 passengers, or 2. Rent Starting at $8,* *Based on total cost for all included at 1hr of flight/shooting time. Set up, travel and additional hourly costs not included in this. is here to arrange and book your private helicopter transportation. Typical helicopter charter services are designed to take you from the major aircraft. To charter a helicopter with us call the numbers above. Why consider helicopter hire in London? They said the centre of London is a. Helicopter Rental Cost per Hour. How much does it cost to rent a helicopter? Helicopter, Coachella Helicopter Charter, Palm Springs, Palm Springs Helicopter Charter. Price is for the R44 and can include up to 3. 20 Destinations - All Under 2 Hours. Prices are subject to demand, prices starting from: If your party is larger than 6, you will need to charter multiple. Robinson R44 Raven II for as low as $5, per month and $ per hour. Option Two – Hourly Cost of Leasing a Helicopter Robinson R22 Beta II for as low as $ The cost to rent a helicopter ranges from $ to $ per hour. Prices vary based on helicopter type and location.

Best Mens Gold Wedding Bands

Metals like tungsten, titanium, and stainless steel are known for their durability, making them ideal for everyday wear. On the other hand, gold and platinum. Tungsten carbide is renowned for being ten times harder than 18k gold. The ring will withstand the test of time without fading and creates a unique fashionable. Here, you'll find the best Wedding Bands styles in Charlotte, North Carolina. Simon G Men's Wedding Band In 14K Gold (White,Rose). $2, Add to Cart. Discover our rugged men's gold wedding bands, crafted from bold and unique materials. Featuring striking yellow gold and rose gold designs, some bands are. Are mens gold wedding bands out of style? ·. No, they're not out of When comparing white gold versus yellow gold wedding bands, there are good. Top 20 Men's Wedding Bands ; 1 ctw Round Lab Grown Diamond Men's Channel Set Wedding Band. Men's Round Channel Set Wedding Band. $1, ; 1 ctw Round Lab Grown. Explore a range of men's rings, from timeless classics to contemporary designs, and find the perfect symbol of your commitment. BESTSELLING BANDS · The Cowboy · The Baller · The Rockstar · The CEO · The Zeppelin · The Gentleman · The Fitzgerald · The Instigator. Explore Blue Nile's selection of high-quality gold wedding bands for men. Choose from 14k or 18k gold with custom designs. Fast shipping is available. Metals like tungsten, titanium, and stainless steel are known for their durability, making them ideal for everyday wear. On the other hand, gold and platinum. Tungsten carbide is renowned for being ten times harder than 18k gold. The ring will withstand the test of time without fading and creates a unique fashionable. Here, you'll find the best Wedding Bands styles in Charlotte, North Carolina. Simon G Men's Wedding Band In 14K Gold (White,Rose). $2, Add to Cart. Discover our rugged men's gold wedding bands, crafted from bold and unique materials. Featuring striking yellow gold and rose gold designs, some bands are. Are mens gold wedding bands out of style? ·. No, they're not out of When comparing white gold versus yellow gold wedding bands, there are good. Top 20 Men's Wedding Bands ; 1 ctw Round Lab Grown Diamond Men's Channel Set Wedding Band. Men's Round Channel Set Wedding Band. $1, ; 1 ctw Round Lab Grown. Explore a range of men's rings, from timeless classics to contemporary designs, and find the perfect symbol of your commitment. BESTSELLING BANDS · The Cowboy · The Baller · The Rockstar · The CEO · The Zeppelin · The Gentleman · The Fitzgerald · The Instigator. Explore Blue Nile's selection of high-quality gold wedding bands for men. Choose from 14k or 18k gold with custom designs. Fast shipping is available.

Since pure gold is too soft to use for jewelry, the best golds for men's wedding bands are 14 and 18 karats. 14k gold contains a smaller portion of gold and. When it comes to choosing a wedding ring, comfort is often a top priority for men. After all, the ring will be worn every day and should feel comfortable to. A gold wedding ring (including white gold, yellow gold, and rose gold in this category) can cost about $ to $1, Platinum mens wedding bands run much. BESTSELLING BANDS · The Cowboy · The Baller · The Rockstar · The CEO · The Zeppelin · The Gentleman · The Fitzgerald · The Instigator. If you're searching for something more unique, our titanium wedding bands or 14K yellow gold wedding bands might be the perfect fit. I purchased FH's ring from Etsy. We got it a few weeks ago and the quality is great and the price was very reasonable. I included the link of the one we chose. BEST SELLERS view all · The Apollo | Men's Hammered Titanium Wedding Band · The Jurassic | Men's Titanium Wedding Band with Dinosaur Bone, Meteorite & Fossilized. If you are searching for a durable men's gold wedding band, an 18k ring is definitely the best choice. · Your next best option in terms of durability is 14k gold. Tiffany wedding bands are timeless and meticulously handcrafted. Discover classic wedding bands for men in platinum and 18k white, yellow and rose gold. You can look into Manly Bands, Elemental Bands, Rings by Lux, Patrick Adair Designs (great for custom rings), and Pillar Stlyes to see if any of. I would try Brilliant Earth. My fiancé has very similar tastes and just wants a plain gold band. I've been looking at the 6mm width in 18k and j. Best Men's Gold Wedding Band: Marke Classic 4mm Yellow Gold Polished Ring · Best Men's Black Wedding Band: JAXXON Single Stud Black Tungsten Ring · Best Diamond. While 18K gold (less pure gold, more alloy metal) can be okay for everyday wear, 14K gold (a little less gold and a little more alloy) is generally recommended. Explore our collection of timeless men's yellow gold wedding bands that will never go out of style. Available in 10k, 14k, and 18k gold. Shop our exclusive collection of male wedding rings at Howard Fine Jewellers. Elegant mens gold wedding band designs for every style and budget. Named after the tantalum that is a staple of their designs, their wedding bands combine the robust look of industrial metal with the regality of gold. The. Popular collections of wedding bands for men include from artisans A. Jaffe, the handsome Art Deco, Metropolitan, and Classics, and from the innovators at. Shop Men's Yellow Gold Wedding Bands · Verragio 14k Yellow Gold 6 mm Natural Diamond Wedding Band 1/2 ct. · Mfit 14k Yellow Gold 8 mm Natural Diamond Wedding Band. Choose from a variety of metals, including white gold, rose gold, yellow gold, platinum, titanium, and more. We also offer two-tone variations, as.

Kitko Gold Price

The Live Gold Price Today page is essential for making informed investment decisions, featuring interactive charts to help users analyze trends and forecast. KITCO Covers The Latest Gold News, Silver News, Live Gold Prices, Silver Prices, Gold Charts, Gold Rate, Mining News, ETF, FOREX, Bitcoin, Crypto. Live Spot Prices for Gold, Silver, Platinum, Palladium and Rhodium in ounces, grams, kilos and tolas in all major currencies. KITCO Covers The Latest Gold News, Silver News, Live Gold Prices, Silver Prices, Gold Charts, Gold Rate, Mining News, ETF, FOREX, Bitcoin, Crypto. The Kitco Gold Index (KGX) is designed to determine whether the value of gold reflects actual changes in its value, shifts in the US Dollar, or a combination. Calculate the Value of Your Scrap Gold with Our Gold Scrap Live Calculator Gold Scrap Calculator. Current Gold Price (USD/oz) (may be adjusted for future. See how Gold is priced against the USD Index, as well as how Silver, Oil, Platinum, Copper and others are doing in relation to the US Dollar and predominant. GoldPrice. WHERE THE WORLD CHECKS THE GOLD PRICE. Holdings. Find out how much faster our free real-time spot and market data is compared to the Kitco live gold prices, helping you to manage your portfolio better. The Live Gold Price Today page is essential for making informed investment decisions, featuring interactive charts to help users analyze trends and forecast. KITCO Covers The Latest Gold News, Silver News, Live Gold Prices, Silver Prices, Gold Charts, Gold Rate, Mining News, ETF, FOREX, Bitcoin, Crypto. Live Spot Prices for Gold, Silver, Platinum, Palladium and Rhodium in ounces, grams, kilos and tolas in all major currencies. KITCO Covers The Latest Gold News, Silver News, Live Gold Prices, Silver Prices, Gold Charts, Gold Rate, Mining News, ETF, FOREX, Bitcoin, Crypto. The Kitco Gold Index (KGX) is designed to determine whether the value of gold reflects actual changes in its value, shifts in the US Dollar, or a combination. Calculate the Value of Your Scrap Gold with Our Gold Scrap Live Calculator Gold Scrap Calculator. Current Gold Price (USD/oz) (may be adjusted for future. See how Gold is priced against the USD Index, as well as how Silver, Oil, Platinum, Copper and others are doing in relation to the US Dollar and predominant. GoldPrice. WHERE THE WORLD CHECKS THE GOLD PRICE. Holdings. Find out how much faster our free real-time spot and market data is compared to the Kitco live gold prices, helping you to manage your portfolio better.

Gold Price in USD per Troy Ounce for Last 5 Years. WEEK AHEAD: Gold prices could be a little too hot as the Fed cools down rate cut expectations More here - bitcoinrevival.site #goldprice. Live Gold Charts and Gold Spot Price from International Gold Markets, Prices from New York, London, Hong Kong and Sydney provided by Kitco. Live Spot Prices for Gold, Silver, Platinum, Palladium and Rhodium in ounces, grams, kilos and tolas in all major currencies. Kitco's new and improved, award-winning* Gold Live!, gives you access to the latest market price quotes, charts, precious metals news and expert opinions in. Kitco's new and improved, award-winning* Gold Live!, gives you access to the latest market price quotes, charts, precious metals news and expert opinions. APMEX offers investors the opportunity to view live and historic spot prices for Silver, Gold, Platinum and Palladium to develop their purchasing. Gold spot prices are universal, as most gold markets use live gold prices listed in U.S. dollars, so the price of gold per ounce is the same worldwide. Shop. Gold price sees another 5% rally this week as geopolitical uncertainty drives the market to touch $ bitcoinrevival.site #kitconews. Gold price slightly down on consolidation, post-FOMC | Kitco News. Source: Buzz FX / America/Chicago. (Kitco News) - [Gold](Read more. bitcoinrevival.site - The No. 1 gold price site for fast loading live gold price charts in ounces, grams and kilos in every national currency in the world. Live Spot Prices for Gold, Silver, Platinum, Palladium and Rhodium in ounces, grams, kilos and tolas in all major currencies. Exchange rates and gold prices are based on the market bid. Update: every minute. Size: Approx: 2. (Kitco News) – Thursday morning's raft of largely positive U.S. data has helped to ease recession worries and boosted stock markets near fresh weekly highs. Kitco's gold survey results are in! Gold price action next week is a coin toss among analysts | #kitconews #gold #silver #finance #preciousmetals. #goldprice #silverprice #gold #silver #markets #crypto #fed #stocks #financialmarkets #inflation · Is the Stock Market Ready to Break Down? · Fed Minutes Reveal. 24 hour $AUD Dollar price per kilo. [Most Recent Quotes from bitcoinrevival.site]. These times are all in New York, USA time over a Not only is the average gold price at an all-time high this year, no, the profit margins are also impressive. The free cash flow of the companies is also. Live Silver Charts and Silver Spot Price from International Silver Markets, Prices from New York, London, Hong Kong and Sydney provided by Kitco. GoldPrice. View Gold/Silver Ratio Charts at the No. 1 Gold Price Site. Holdings. Calculators. Calculator options.

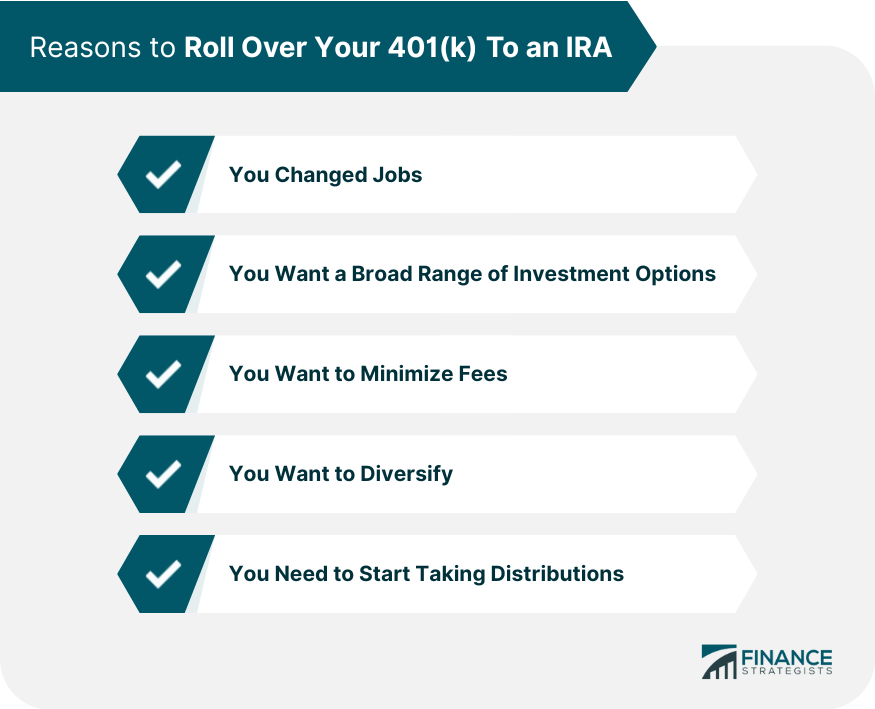

Best Time To Roll Over 401k To Ira

Depending on your circumstances, if you roll over your money from your old (k) to a new one, you'll be able to keep your retirement savings all in one place. When you leave an employer, you typically have four options for what do with your savings from a qualified employer sponsored retirement plan (QRP) such as a. The short answer is yes – you can roll over your (k) while still employed at the same place. Leaving an employer isn't the only time you can move your (k. A direct rollover occurs when your plan issues a check or securities payable directly to an IRA custodian for your benefit. It's generally a non-taxable. A rollover is essentially the transfer of one investment account to another. Most commonly, it occurs between qualified retirement accounts (like when you. A rollover IRA is an individual retirement account (IRA) that you create when you want to move your money from a tax-qualified retirement account. The cons: Once you roll your funds into an IRA, they may no longer be eligible for a future rollover into a (k) plan, and RMDs apply at age Note that if the administrator withholds taxes, you will have to make up the difference when you deposit your funds into the new retirement account. If you do. When should I roll over? You have 60 days from the date you receive an IRA or retirement plan distribution to roll it over to another plan or IRA. The IRS may. Depending on your circumstances, if you roll over your money from your old (k) to a new one, you'll be able to keep your retirement savings all in one place. When you leave an employer, you typically have four options for what do with your savings from a qualified employer sponsored retirement plan (QRP) such as a. The short answer is yes – you can roll over your (k) while still employed at the same place. Leaving an employer isn't the only time you can move your (k. A direct rollover occurs when your plan issues a check or securities payable directly to an IRA custodian for your benefit. It's generally a non-taxable. A rollover is essentially the transfer of one investment account to another. Most commonly, it occurs between qualified retirement accounts (like when you. A rollover IRA is an individual retirement account (IRA) that you create when you want to move your money from a tax-qualified retirement account. The cons: Once you roll your funds into an IRA, they may no longer be eligible for a future rollover into a (k) plan, and RMDs apply at age Note that if the administrator withholds taxes, you will have to make up the difference when you deposit your funds into the new retirement account. If you do. When should I roll over? You have 60 days from the date you receive an IRA or retirement plan distribution to roll it over to another plan or IRA. The IRS may.

When you take the cash directly, the IRS only allows you 60 days from the date of receipt of the funds to rollover the funds to another plan or IRA. If you. It is a process that allows you to move funds from your previous employer-sponsored retirement plan, a (k), for example, into an IRA. When you roll over your. Your balance. Depending on your (k) balance, your former employer may give you more or less time to decide what to do with the money. · Where to rollover. If. When deciding between an employer-sponsored plan and IRA, there may be important differences to consider, such as range of investment options, fees and expenses. Depends on the fund choices and fees. If able, it's better to avoid an ira force out if the old job terminates the plan. When completing a retirement rollover, it's important to understand direct vs indirect rollover. Learn how to roll your K into an IRA. Rolling over a (k) is an opportunity to simplify your finances. By bringing your old (k)s and IRAs together, you can manage your retirement savings. A Rollover IRA is a retirement account that allows you to roll money from your former employer-sponsored retirement plan into an IRA. Thus, you can keep your money in the account and let it grow tax-deferred for a longer period of time compared to an IRA. Limited Backdoor Roth Option. Roth. Roll over your old (k) into an IRA as soon as possible. IRA fees are both more transparent and lower than (k) fees, you have a much wider range of. When you rollover your (k) to a IRA or another (k) plan, you can utilize the day rollover rule to borrow money tax- and penalty-free. The catch is you. When you roll over retirement plan assets, you're moving them from a group plan into an IRA (which generally offers greater investment flexibility). An IRA at. Can she roll instead to the k? A Traditional IRA gets in the way of Backdoor Roth contributions just in case you think you might want to. When you rollover your (k) to a IRA or another (k) plan, you can utilize the day rollover rule to borrow money tax- and penalty-free. The catch is you. A (k) rollover to an IRA is when you move funds from a (k) to a traditional or Roth IRA. Retirement account holders do this to take advantage of lower. The quickest way to rollover your (k) money to an IRA is through a direct rollover. When doing a direct rollover, the (k) plan administrator will. Learn how to rollover an existing (k) Additional fees should be considered when moving assets to an IRA (for example, transfer fees may apply). In most cases, you should roll over your (k) balance when you leave a job. Two common options are rolling your balance over to a new (k) or IRA. By. The quickest way to rollover your (k) money to an IRA is through a direct rollover. When doing a direct rollover, the (k) plan administrator will. While they're all retirement savings plans, there are important distinctions between them. A (k) is an employer-sponsored retirement account. When you work.

Cost To Install Your Own Solar Panels

Their cost is between 90 cents and $1 per watt. Thin-film solar panels, which have an efficiency rate ranging from 10% to 13%, are the least efficient solar. This implies that an average 6-kilowatt (kW) residential solar system would cost about $20, without any incentives or rebates. However, the cost of a solar. The average cost of solar panel installation by a professional solar company is around $ per watt. For a typical 5 kW (5, watt) solar panel system, that. Still, the average price of solar panels and installing the equipment often range from $30, to $70, and depends on factors such as your home's square. The cost of the panels & installation was about $28, This will be offset by the generous 26% federal solar energy tax credit in next year's. Residential solar panels are typically 3kW to 8kW in size and may cost between $9, to $24, in total installation expenses.” Naturally, you're asking why. Based on Location & Wattage for a 5kW-6kW System: $ - $/watt. Arizona: $$/watt; California: $$/watt; Colorado: $$/watt. They tend to cost around $ to $1 per watt. That's roughly $4, to $6, total for a 6 kW system. Labor. Installation costs—including. I can give a rough estimate of about $3 to $4 USD per watt of PV solar panel for a typical home sized grid tied PV power system. Their cost is between 90 cents and $1 per watt. Thin-film solar panels, which have an efficiency rate ranging from 10% to 13%, are the least efficient solar. This implies that an average 6-kilowatt (kW) residential solar system would cost about $20, without any incentives or rebates. However, the cost of a solar. The average cost of solar panel installation by a professional solar company is around $ per watt. For a typical 5 kW (5, watt) solar panel system, that. Still, the average price of solar panels and installing the equipment often range from $30, to $70, and depends on factors such as your home's square. The cost of the panels & installation was about $28, This will be offset by the generous 26% federal solar energy tax credit in next year's. Residential solar panels are typically 3kW to 8kW in size and may cost between $9, to $24, in total installation expenses.” Naturally, you're asking why. Based on Location & Wattage for a 5kW-6kW System: $ - $/watt. Arizona: $$/watt; California: $$/watt; Colorado: $$/watt. They tend to cost around $ to $1 per watt. That's roughly $4, to $6, total for a 6 kW system. Labor. Installation costs—including. I can give a rough estimate of about $3 to $4 USD per watt of PV solar panel for a typical home sized grid tied PV power system.

The upfront price for an average-sized residential solar system has fallen from $40, in to about $25, today. Meanwhile, utility-scale solar now costs. I also do inverters starting at $ for a 3kw renogy inverter. I do Ah lithium batteries for $ installed, and aH self-heating lithium batteries for. The average cost of installing solar panels is anywhere from $15, to $25, depending on the size of your home and where you live. This is because, with. There are a variety of factors that will impact the total cost of your South Carolina solar panel installation, but on average, SC homeowners spend between. On average, DIY solar panel installation costs between $7, and $18,, depending on the size of the system. The amount of installation labor you need for your solar panel system is largely a function of the number of panels you need installed. Professional installers. Solar Panel Kits. The cost of DIY solar panels runs $2, to $20, for a kit ranging from 2kW to 10kW. These kits include everything you need to install your. After applying these incentives, a typical homeowner can expect to pay between $18, and $38, for 5 kW to a 15 kW solar panel system. For commercial solar. You'll pay an average of $12, to install a 5 kilowatt solar panel system in California, before incentives. The federal investment tax credit (ITC) lowers. Including installation, most residential solar installations cost somewhere between $ and $ per watt, according to the Center for Sustainable Energy. Range of price is anywhere from $3-$5/W, depending on where you live and the details of your system. So, $12, - $20, That's before any. Based on the cost of DIY solar panel kits from companies like Renege and Grape Solar, the average cost per watts (W) is between $ and $ Solar Panel Installation Stat According to a January article published by Forbes, the average cost of solar panels is $16,, which can double based on. Use two end clamps to install the first panel on the rails. Then, use grounding mid clamps for each consecutive panel – mid clamps bound the solar panels and. A 10 kW to 2 MW commercial solar panel system costs $ per watt before any tax rebates or incentives. · Commercial solar installation costs for small and mid-. The national average cost of solar panels for residential use is $3-$5 per watt. The average price of labor per watt for installation is about 50 cents. The national average cost of solar panels for residential use is $3-$5 per watt. The average price of labor per watt for installation is about 50 cents. Solar Panel Kits. The cost of DIY solar panels runs $2, to $20, for a kit ranging from 2kW to 10kW. These kits include everything you need to install your. A fully installed solar system typically costs $3 to $5 per watt before incentives like the 30% tax credit are applied. Using this measurement, 5, Watt solar. If you're going DIY and buying panels yourself, you're looking at around $ per panel ( watts x 1 dollar). Keep in mind that this is before tax rebates!